Acorns is a micro-investing and robo-investing company headquartered in Irvine, California. Acorns had 8.2 million customers and $3 billion in assets under management in 2020, according to Fortune’s Impact 20 list.

Walter and Jeff Cruttenden, a father-and-son entrepreneurial team, founded Acorns in 2014. Walter, the father, also founded Roth Capital and was the founder and CEO of E*Trade’s investment banking division.

CEO Noah Kerner, who previously led creative branding agency Noise and was Chief Strategy & Marketing Officer for WeWork, now leads the company. Kerner attracted investors including high-profile celebrities such as Jennifer Lopez and Alex Rodriguez as part of an effort to grow Acorns’ user base to 100 million customers.

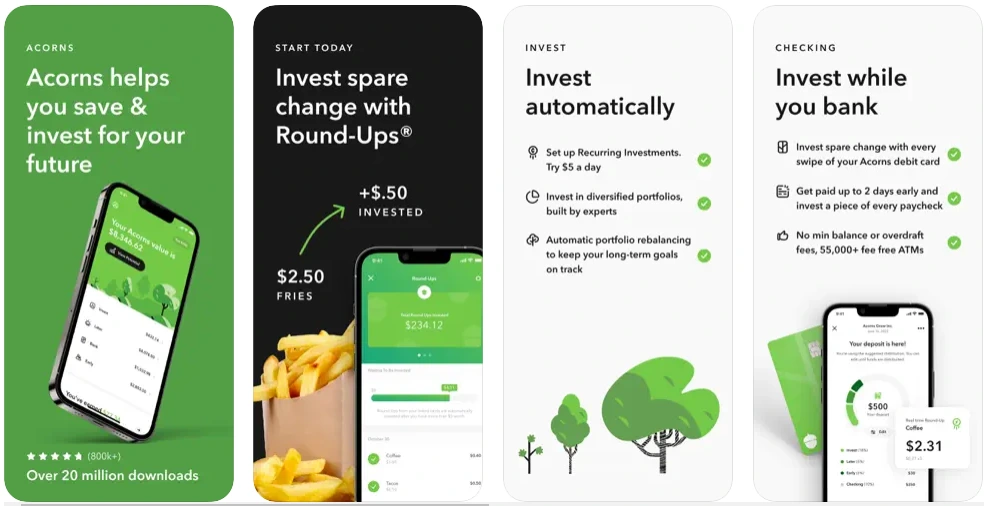

Acorns’ main saving and investing products are Invest, Later, Spend, Found Money, and Early.

This is a taxable investment account in which your money is invested in exchange-traded funds (ETFs) that have been selected for you based on your risk tolerance and financial goals. Round-ups, recurring deposits, and on-demand deposits can all be used to fund the account. Setting up recurring contributions—Acorns allows users to contribute as little as $5 at a time—is your best bet for building your portfolio through dollar-cost averaging.

This is a taxable individual retirement account (IRA). Your portfolio, like Acorns Invest, is made up of ETFs. We were perplexed by the Invest/Later terminology, because your Acorns Invest funds are not intended for day trading or immediate use. Whatever the goal, all investing is for the long term.

A checking account that includes a debit card and does not charge any fees, such as minimum balance fees. It also covers some ATM fees. Another feature, Smart Deposit, allows you to automatically transfer money from a direct deposit in your Spend account to other accounts, such as Invest.

An online marketplace that gives a small percentage of your purchase price back at hundreds of major retailers, including Walmart. The money you save when you shop on Found Money is deposited into your Acorns Invest account.

This is a UTMA/UGMA account available to those paying Acorns’ most expensive tier, allowing parents to set up accounts for their children without dealing with cumbersome red tape.

Acorns’ robo-advisor features are most appealing to those who are drawn to the platform’s “round-up” savings claim-to-fame: purchases made in linked accounts are rounded up to the nearest dollar, and the balance is saved in an investment account.

For example, if you spent $4.50 on a latte using a linked credit card, an additional $0.50 would be charged to your card and deposited into your investment account. If you’ve had success with this pro-savings gimmick, you might be interested in saving for retirement with Acorns as well.

Nonetheless, rival robo-advisors offer more robust services at a lower cost. Only those who believe they will be enticed to save more with Acorns should apply.

Acorns, like most other robo-advisers, provides its customers with a diversified portfolio of low-cost ETFs tailored to their risk tolerance and goals based on how they respond to a few questions.

You’ll be asked your age, net worth, income, and when you might need the money. Acorns selects your portfolio from nearly 25 ETFs. Forbes Advisor created a profile of a young, upper-middle-class worker with a long investment horizon. Acorns responded with a “Aggressive Portfolio” that included the following allocations:

Unlike competitors such as Wealthfront, our Acorns portfolio consisted of only four low-cost ETFs, all with extremely low expense ratios—the operating fees charged by the funds in which you invest. This simplified approach simplifies your investments while not sacrificing returns.

A portfolio comprised entirely of stocks, on the other hand, may be too risky, even for a risk-tolerant younger worker. You can switch to a different portfolio, but be cautious: your customized portfolio is based on the questionnaire, so going against the grain may result in holding too little risk rather than too much risk.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |